Why IUL Insurance is a Game-Changer for Your Financial Future

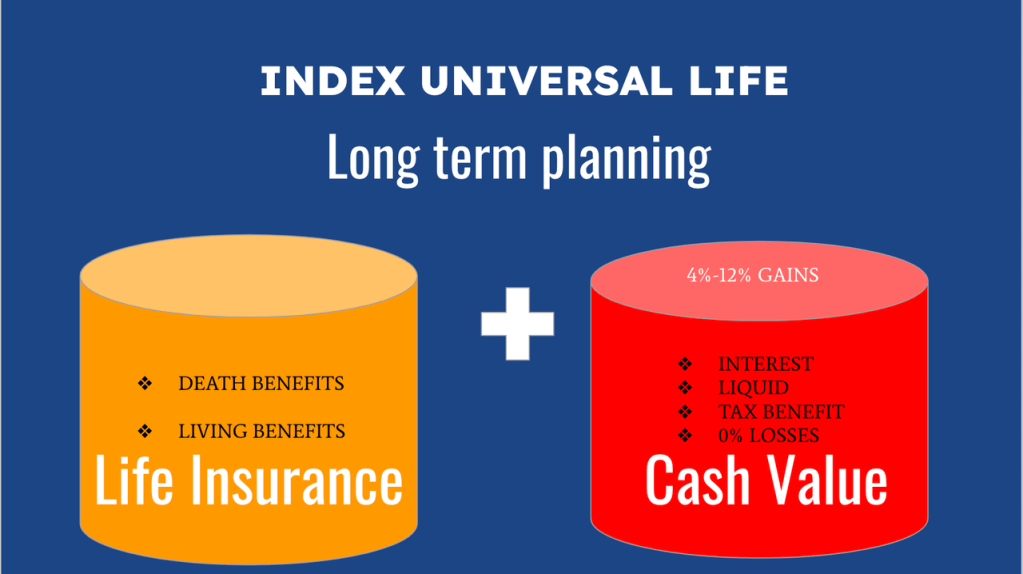

Imagine having life insurance that not only protects your loved ones but also builds wealth over time. That’s exactly what Index Universal Life (IUL) Insurance offers. It’s a permanent life insurance policy that provides lifetime coverage while allowing you to grow cash value based on the performance of a stock market index like the S&P 500—all with downside protection.

Many people think of life insurance as just a safety net, but IUL is much more. It can be a powerful financial tool for building a tax-free retirement, supplementing income, and creating a lasting legacy.

How Does IUL Insurance Work?

Index Universal Life Insurance combines permanent life insurance coverage with a market-linked savings component. Instead of earning a fixed interest rate, your policy’s cash value grows based on the performance of a stock market index, such as:

✅ S&P 500 – Tracks the 500 largest U.S. companies

✅ NASDAQ-100 – Focuses on top technology and growth stocks

✅ Dow Jones Industrial Average (DJIA) – Represents 30 major corporations

The best part? Even when the market drops, you don’t lose money because your policy has a guaranteed minimum interest rate (floor) to protect your savings.

Key Benefits of Index Universal Life Insurance

💰 Tax-Free Growth & Withdrawals – Your cash value grows tax-deferred, and you can access funds tax-free through policy loans

📈 Market-Linked Growth Without Risk – Enjoy stock market gains without the risk of losing money due to a built-in safety floor

🏡 Permanent Coverage – Unlike term life, IUL never expires, as long as you keep up with premiums

🔄 Flexible Premiums & Death Benefits – Adjust your premium payments and coverage as your financial situation changes

🚀 Supplemental Retirement Income – Use your cash value as tax-free income in retirement, reducing dependence on 401(k)s or IRAs

🛡 Living Benefits for Critical Illness & Disability – Some IUL policies include early access to funds in case of a serious illness or disability

Is IUL Right for You?

IUL is ideal for:

✔️ People who want life insurance + tax-free retirement savings

✔️ Homeowners and parents looking to protect their family’s future

✔️ Business owners who need long-term financial security

✔️ Those seeking an alternative to traditional retirement accounts

✔️ Anyone who wants market-linked growth without market risk

If you’re looking for a financial tool that protects your loved ones while growing your wealth, Index Universal Life Insurance could be the perfect solution.

Start Building Your Financial Future Today

Index Universal Life Insurance is more than just life insurance—it’s a way to build wealth, protect your family, and create a tax-free legacy.

💡 Ready to explore your IUL options? Contact us today for a free consultation and quote!

- Index Universal Life Insurance

- IUL insurance benefits

- best IUL policies

- cash value life insurance

- tax-free retirement with IUL

- market-linked life insurance

- how IUL works

- IUL vs whole life insurance

Leave a comment